What is W2 Form.Meaning, Components, Uses and Facts of W2

Introduction:

Seeking for the right job and position to build up your career in the USA requires going through with a lot of procedures and time to invest. While in this procedure most of the candidates have a huge confusion about the term W2 form and its process. Under this blog, we have come with the simplest form of information which will resolve all your doubts regarding W2 form.

Meaning :

A form that is compulsory to send every employee and Internal Revenue Service (IRS) at the end of every year by their employer is known as a W2 form or Wage and Tax Statement.

The employer needs to generate a completed W2 form from all the employees to whom they pay salary, wages or other forms of compensation against employment. The completed forms are required to be mailed or submitted on or before January 31st. This deadline ensures 2 months of time left with the taxpayers to prepare with returns before April 15 (Due date for paying Income Tax).

For more information related to the procedure of tax payment, check out our blog!

Uses of W2 Form:

The point stated below describes the uses from W2 form.

A W2 form consists of information about the employee’s annual return along with the amount of tax that is deducted from their paycheques.

The W2 form allows the employer to deduct with a liable tax amount from their paycheques and submit it to the government.

W2 forms are also used to submit throughout the year paid tax amount of the employees to the Federal Insurance Contribution Act (FICA).

Employers are required to file the W2 form of all the employees along with the W3 form with the Social security Administrator (SSA).

The submitted information to the SSA is used in order to find with Social Security benefits.

Components of W2 form:

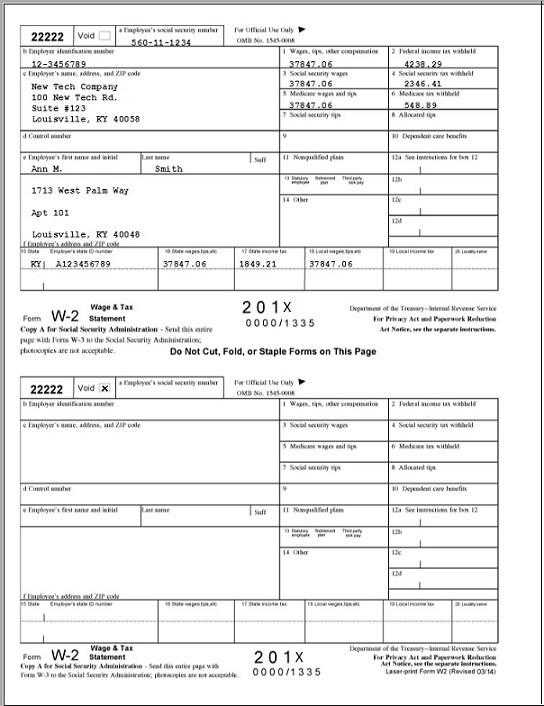

The submitted W2 forms are divided under state and federal sections in order to submit on both the levels.

W2 form consists of the employer’s information along with the company’s Employment Identification Number (EIN)

Information about the employer’s state Id number also needs to be mentioned.

Other fields consist of the details concerning the employee’s income from previous years.

The amount deducted from the income as a payment of tax from the employee’s paycheque’s included in the W2 form and is further submitted to Federal Income Tax, Social Security Tax, and more.

The amount of liable tax is being deducted from employee’s income if the amount deducted exceeds the amount liable then the exceeded amount is refunded.

IRS may audit the taxpayer, under the case where the income report submitted doesn’t matches with the income as per the W2 Form.

The taxpayer is bound to submit with the details about all the salary, wage, and tip income even under the case if failed to mention in the W2 form.

Employer requires filling with both the numbered as well as lettered boxes in a W2 form.

Name and address of both employee and employer along with employer’s EIN, employee’s SSN and state Id number is mentioned in the lettered boxes from A to F.

Taxable income is mentioned in box 1 including wages, salary, tips, and bonuses. Under Box 2 information related to the deducted liable amount from the income is mentioned.

Details’ concerning the numbers of earnings are subject to Social security tax is mentioned under box 3 and the amount of Social security tax that was withheld under box 4.

Information relating to Medicare tax and amount withheld is mentioned under boxes 5 and 6.

For the employees having earning from tips need to mention under box 7 and 8.

Box 9 is left empty as it was used to represent with defunct tax perks.

Under box 10 employer mentions with the (if applicable) in dependent care benefits.

Deferred compensation of an employee received under a non-qualified plan by their employer is mentioned under box 11.

Deferred and compensations, as well as single or double letter code that corresponds to each, are covered under box 12.

Box 13 represents information to be mentioned only if you are paid by the third party for sick pay or insurance.

Other information that an employer wants to specify can be filled under box 14.

Box 15 to 20 is to be filled with information related to states and local taxes.

General FAQ’s on W2 form:

You might come across some of the frequently asked questions related to W2 form.

Therefore, listed frequently asked questions along with answers will surely be helpful.

1. What is the meaning of W2 employees?

A W2 employee work under a company that ensures their Social Security, Medicare Taxes and pay employer pay taxes.

2. What is a W2 form used for?

The purpose of W2 forms is to report employee’s annual wages as well as a federal state and liable local taxes deducted from their paycheques by the employer.

3. Salary on W2?

Under W2 a worker is considered as an employee, it generally refers to an hourly rate which an employer wants you to work on.

4. What do boxes on the W2 form represent?

The boxes and codes on the W2 form represent the amount of your income as well as the taxes withheld from it.

5. What is the total state?

The total of liable state tax which needs to be calculated is mentioned under state tax. The employer is supposed to have with details of your state Id number.

6. What could result if I don’t file a W2 form?

Under the case, if you haven’t submitted with your W2 IRS will send you a notice on your mail.

7. How am I supposed to pay tax if I work in two states?

Under such a case if you are not having with a reciprocity agreement then you need to pay to both the states with taxes from your earnings.

8. How could I find my W2 online?

W2 can be received online or from your employer. In case if it’s for the previous year you can also receive it from SSA by paying $86. Or can also receive a wage and income transcript from the IRS that represents the wages reported to the IRS by the Employer.

9. C2C Vs W2?

The basic difference is that under W2 the liable taxes are paid by the employer to the IRS and on C2C employee would be working for other corporation meanwhile on other company’s payroll. Click here to know more.

10. Is working on W2 means to work on full time?

Under full time a person receives with others like a vacation, insurance, etc. While under W2 a person works on an hourly pre-decide rate without other benefits.

Closure:

While in the process of filing taxes might sound confusing but a little research and expert help will surely work. Under this blog, we have tried to mention with most of the essential details, in case if you are having more questions kindly leave it here.

For more information and help from United OPT contact us today!

Clara Michael

Clara Michael is a Career Counsellor and Legal advisor at United OPT. she has very good working experience with OPT, CPT and H1B candidates. She has a vast knowledge of recruitment and immigration laws. Through her experience and knowledge, she is giving her best to support the international student community in the USA. Do share the article if you like it.